ri tax rate by town

Detailed Rhode Island state income tax rates and brackets are available on. Town of North Smithfield Office of Tax Collector 83 Green Street North Smithfield RI 02896.

State Taxes In Every Us State And Dc Ranked Lovemoney Com

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per.

. 2 Municipality had a revaluation or statistical update effective 123120. Tax amount varies by county. RI-1040 line 8 or Over But not over RI-1040NR line 8 0 66200 150550 Over Page T-1 66200 150550 375 b Multiplication.

2022 Child Tax Rebate Program. Rhode Island has a. The Municipality determines the amount of revenue R to be raised.

Credit card payments can be made. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. 3243 combination commercial I commercial II industrial commercial.

Barrington RI Sales Tax Rate. 39 rows Little Compton has the lowest property tax rate in Rhode Island with a tax rate of 604. In person or drop box located at 83 Green St.

4 West Warwick - Real Property taxed at four different rates. The Municipality divides the revenue R by. Newport RI Sales Tax Rate.

Newport East RI Sales Tax Rate. Lowest sales tax 7 Highest sales tax. RI Shoreline Change Special Area Management Plan.

How are tax rates set. The Rhode Island property tax rates are set in dollars per 1000 of assessed value. See more ideas about estate tax rhode island towns.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. The median property tax in Rhode Island is 135 of a propertys assesed fair market value as property tax per year. Dec 24 2012 - Explore The DiSpirito Teams board RI Real Estate Tax Rates by Town on Pinterest.

RI-1040 line 7 or Enter here and on RI-1040NR line 7 is. 41 rows Vacant land in West Greenwich is taxed at 1696 per thousand dollars of the assessed value. For example if your property is located in a Rhode Island city or town with a rate of.

3 West Greenwich - Vacant land taxed at. Bristol RI Sales Tax Rate. Tax Year Resident Rate Non-Resident Rate Commercial Rate Tangible Rate.

1 Rates support fiscal year 2021 for East Providence. The Municipality then totals all the assessments A. Newport County RI Sales Tax Rate.

Rhode Island has one of the highest. Real Tangible Tax Rate - 20211152 per 1000 Non-Sewer District1206 per 1000 Sewer DistrictMotor Vehicle Tax Rate - 20212967 per 1000 500 State Exemption and 4500. 3470 apartments 6 units.

North Kingstown RI Sales Tax Rate. 78 rows 2022 List of Rhode Island Local Sales Tax Rates. Lets discuss the Top 5 Highest Property Tax Towns in Rhode Island and commend the Top 5 Lowest Property Tax Towns in RI.

Rhode Island also has a 700 percent corporate income tax rate. Is your homes assessed value corre.

Golocalprov Ri Has The 5th Highest Tax Burden In U S

Map Of Rhode Island Property Tax Rates For All Towns

2022 Property Taxes By State Report Propertyshark

Map Of Rhode Island Property Tax Rates For All Towns

Lists Rhode Island Property Tax Rates

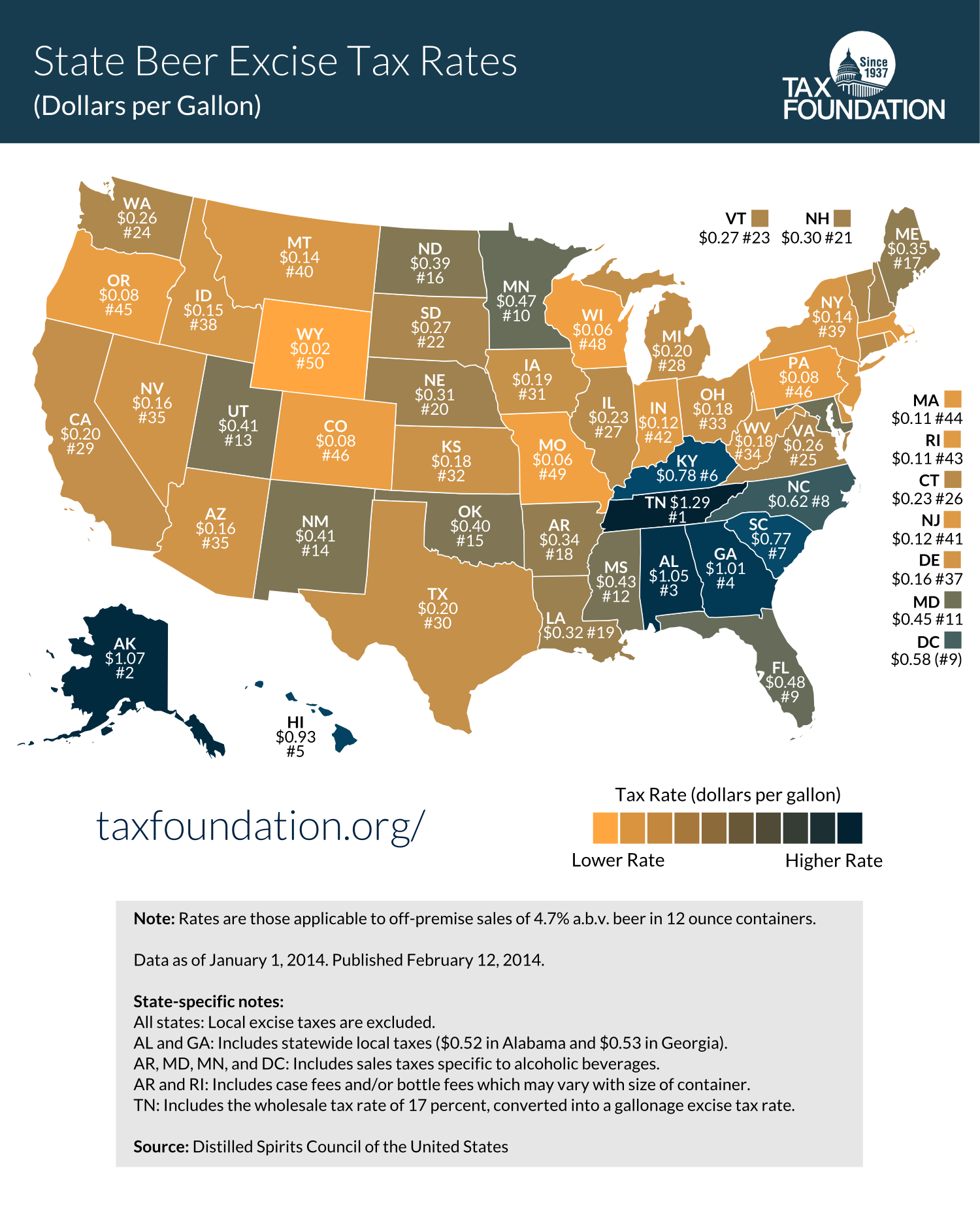

Map Beer Excise Tax Rates By State 2014 Tax Foundation

Rhode Island Property Tax Calculator Smartasset

Charlestown Commission Recommends Budget With Reduced Spending Level Tax Rate Charlestown Thewesterlysun Com

Seven Things To Know About The R I House Finance Budget The Boston Globe

Report R I S Top Marginal Income Tax Rate Fourth Highest In N E

Golocalprov The Highest Car Taxes In Rhode Island

Map Of Rhode Island Property Tax Rates For All Towns

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Map Of Rhode Island Property Tax Rates For All Towns

Rhode Island Sales Tax Calculator Reverse Sales Dremployee

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

How Do State And Local Property Taxes Work Tax Policy Center